A utility meter company I was coaching, part of a large multinational, delayed a customer delivery by a week so it would not book more profits than it had predicted for that quarter. They feared it would hurt their stock prices. Numerous studies have shown that long-term revenues are the primary driver of stock value. Yet executives at this company purposely chose to disappoint a major customer on the mistaken belief that doing so was important for shareholders—and, no doubt, their bonuses linked to that value.

A utility meter company I was coaching, part of a large multinational, delayed a customer delivery by a week so it would not book more profits than it had predicted for that quarter. They feared it would hurt their stock prices. Numerous studies have shown that long-term revenues are the primary driver of stock value. Yet executives at this company purposely chose to disappoint a major customer on the mistaken belief that doing so was important for shareholders—and, no doubt, their bonuses linked to that value.

The sad irony is that they probably also drove down the long-term value, as you’ll see in a moment. If you’re trying to convince top leaders to buy into the Agile Mindset, one angle is convincing them that making customer satisfaction their highest priority—explicitly called for in the Agile Manifesto—is better for shareholders, and them personally.

Finding companies that focus on “cust sat” is as easy as looking to the American Customer Satisfaction Index, “started in the United States in 1994 by researchers at the University of Michigan, in conjunction with the American Society for Quality… and CFI Group,” per its website. The index scores hundreds of companies based on interviews of customers. Among its findings over nearly 30 years is, “Customer satisfaction is a leading indicator of company financial performance. Stocks of companies with high ACSI scores tend to do better than those of companies with low scores.”1 That term “leading indicator” is important. It means that the direction of a company’s cust sat predicts the direction its stock later takes.

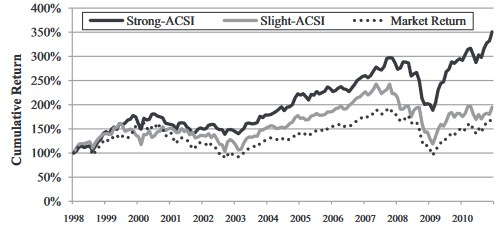

But how do those stocks compare to the market average? A team of researchers formed portfolios of individual stocks from companies with above-average and increasing ACSI scores, and compared it to another with below-average and decreasing ones. From 1998 to 2011, during which the market rose more than 150%, the lower-scoring portfolio went up about 200%, but the high and rising group more than 350%!2:

Another study compared the top 40% of firms with the bottom 20%, and found the stocks of the top ones beat the bottom ones “by approximately 4%–6% per year, even after accounting for industry effects.” An anomaly you may have noticed above is that all of the ACSI firms, after allowing for differences like total assets, showed higher-than-market returns. The researchers could only guess that the greater visibility from being on the list might give investors the sense those companies are industry players worth investing in, even at lower rates of return.3 Yet another study found cust sat was related to market value directly, and also indirectly by affecting stock buyer’s expectations.4

By now I hope you’re wondering how to improve customer satisfaction. The ACSI metrics are:

- “Customer Expectations”: “the customer’s anticipation of the quality of a company’s products or services.” Before the first purchase, this is based on “advertising and word-of-mouth,” and afterward by “a forecast of the company’s ability to deliver quality in the future.”

- “Perceived Quality”: “customer’s evaluation… of the quality of a company’s products or services.” This includes “both customization, which is the degree to which a product or service meets the customer’s individual needs, and reliability, which is the frequency with which things go wrong with the product or service.”

- “Perceived Value”: “quality relative to price paid.”

A different study compared a variety of satisfaction metrics (average satisfaction, complaints, recommendations, etc.) against six different measures of firm financial performance. An average score like ACSI’s was the best predictor of every financial measure. Low complaints and likelihood of repurchasing predicted most of them. I was shocked to see that word-of-mouth recommendations and “net promoter” scores had almost no connection to any financial measures.5

In other words, quality, value (not cost by itself), and features meeting the customer’s needs when the product or service is delivered maximize owner returns and other metrics CEOs use. (For more evidence see, “Melt Down the Iron Triangle.”)

If that isn’t enough to convince executives to shift their focus from short-term stock prices and profits, point out that cust sat may also raise their own bonuses. Two researchers compared ACSI ratings to later CEO bonuses and found compensation boards do incorporate cust sat scores into their bonus decisions, in addition to traditional measures like revenues and stock prices—which we know are also raised by customer satisfaction!6

Maybe self-interest will finally win the argument.

1 ‘The American Customer Satisfaction Index Home’ <https://www.theacsi.org/> [accessed 4 November 2021].

2 Chi-Lu, Peng, Lai Kuan-Ling, Chen Maio-Ling, and Wei An-Pin, ‘Investor Sentiment, Customer Satisfaction and Stock Returns’, European Journal of Marketing; Bradford, 49.5/6 (2015), 827–50 <http://dx.doi.org.csuglobal.idm.oclc.org/10.1108/EJM-01-2014-0026>.

3 Sorescu, Alina, and Sorin M. Sorescu, ‘Customer Satisfaction and Long-Term Stock Returns’, Journal of Marketing, 80.5 (2016), 110–15 <https://doi.org/10.1509/jm.16.0214>.

4 O’Sullivan, Don, and John McCallig, ‘Customer Satisfaction, Earnings and Firm Value’, European Journal of Marketing; Bradford, 46.6 (2012), 827–43. <http://dx.doi.org.csuglobal.idm.oclc.org/10.1108/03090561211214627>.

5 Morgan, Neil A., and Lopo Leotte Rego, ‘The Value of Different Customer Satisfaction and Loyalty Metrics in Predicting Business Performance’, Marketing Science; Linthicum, 25.5 (2006), 426-439,548-549.

6 O’Connell, Vincent, and Don O’Sullivan, ‘The Impact of Customer Satisfaction on CEO Bonuses’, Journal of the Academy of Marketing Science; New York, 39.6 (2011), 828–45 <http://dx.doi.org.csuglobal.idm.oclc.org/10.1007/s11747-010-0218-1>.